Taxation in Malta may sound difficult to compute VAT but with the proper strategy, it is easy and simple to compute. Being a business owner, freelancer or simply managing your personal finances as an expat, it is essential to have the knowledge of VAT and remain abreast of the taxation regulations in Malta.

This a guide will walk you step wise in the calculation of VAT in the right way. Whether it comes to determining the right rate to charge your products or services, dealing with discounts, imports, and prices that include VAT, you will be able to learn the practical techniques and clear-cut examples that will make VAT in Malta simple to deal with.

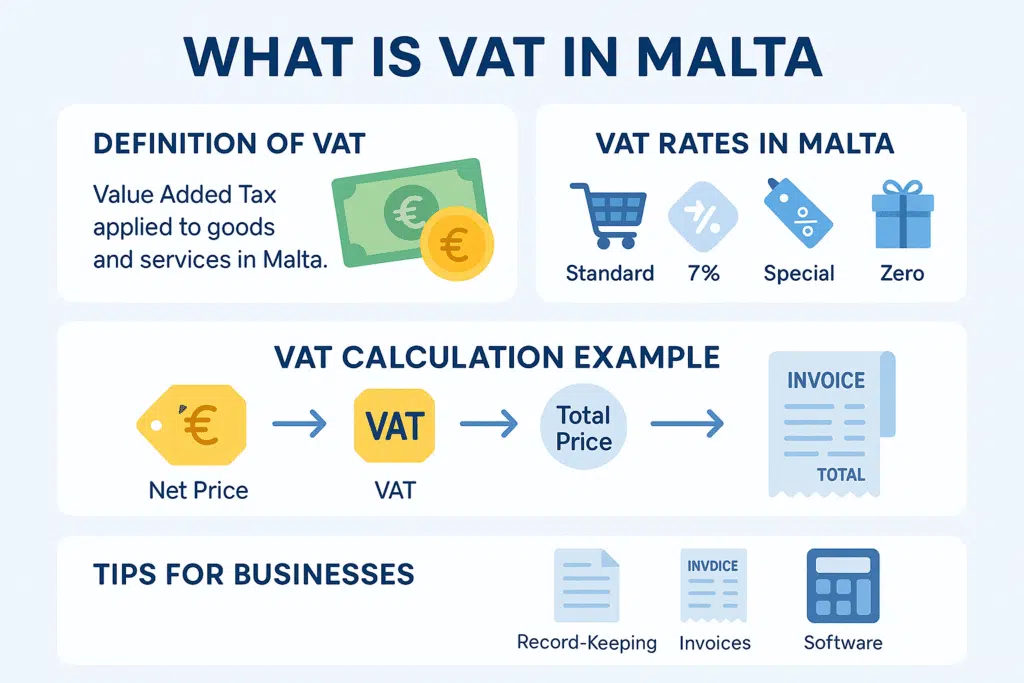

What Is VAT in Malta?

Value Added tax or VAT is a consumption tax that is levied on goods and services in Malta. Companies that are registered for VAT pay this tax to their clients and pay it to the government of Malta. VAT is supposed to be imposed at various levels of production or distribution and finally paid by the final consumer.

Key Features of VAT in Malta

- Standard VAT Rate: 18%

- Reduced Rates: 7% (certain goods and services) and 5% (specific goods)

- Zero Rate: There are goods/services, on which taxes are not charged or charged at 0 percent

- VAT Registration: It is obligatory when the business has a turnover of over EUR35000 in one year (in the case of goods) or EUR24000 (in the case of services)

Know the VAT Rate Applicable to Your Product or Service

In calculating the VAT, the rate of VAT to be calculated is:

- Standard Rate (18%) – Most goods and services.

- Reduced Rate (7%) – This rate is applicable to some items, such as some food products, hotel lodging, and pharmaceuticals.

- Super Reduced Rate (5%) –This is a rate that is applied to certain products such as books, newspapers, and medical equipment.

- Zero Rate (0%) – Goods and some international services that are exported.

It is imperative to have the right rate; otherwise, a wrongly applied rate can lead to fines or penalties.

Determine the Taxable Amount

Goods or services that are subject to taxation are the value of these products or services without VAT. This is commonly known as the net price.

For example:

- Selling price of a laptop: €500 (net)

- VAT Rate: 18%

Here, €500 is the taxable amount.

Calculate VAT Amount

To calculate VAT, use the following formula:

VAT Amount = Net Price × VAT Rate

Example with 18% standard rate:

- VAT Amount = €500 × 0.18 = €90

So, the total price including VAT:

Total Price = Net Price + VAT Amount

Total Price = €500 + €90 = €590

Reverse Calculation (VAT Inclusive Price)

Sometimes, prices already include VAT, and you need to find the net price. Use this formula:

Net Price = Total Price ÷ (1 + VAT Rate)

Example:

- Total Price: €590 (VAT included)

- VAT Rate: 18%

Net Price = 590 ÷ 1.18 ≈ €500

VAT Amount = 590 − 500 = €90

This is helpful for accounting purposes or issuing invoices.

VAT on Discounts and Special Offers

If you offer a discount, VAT is calculated after the discount is applied, not before.

Example:

- Original price: €500

- Discount: €50

- Net Price after discount = €450

- VAT = 450 × 0.18 = €81

- Total Price = 450 + 81 = €531

Always apply VAT to the reduced price to ensure accurate compliance.

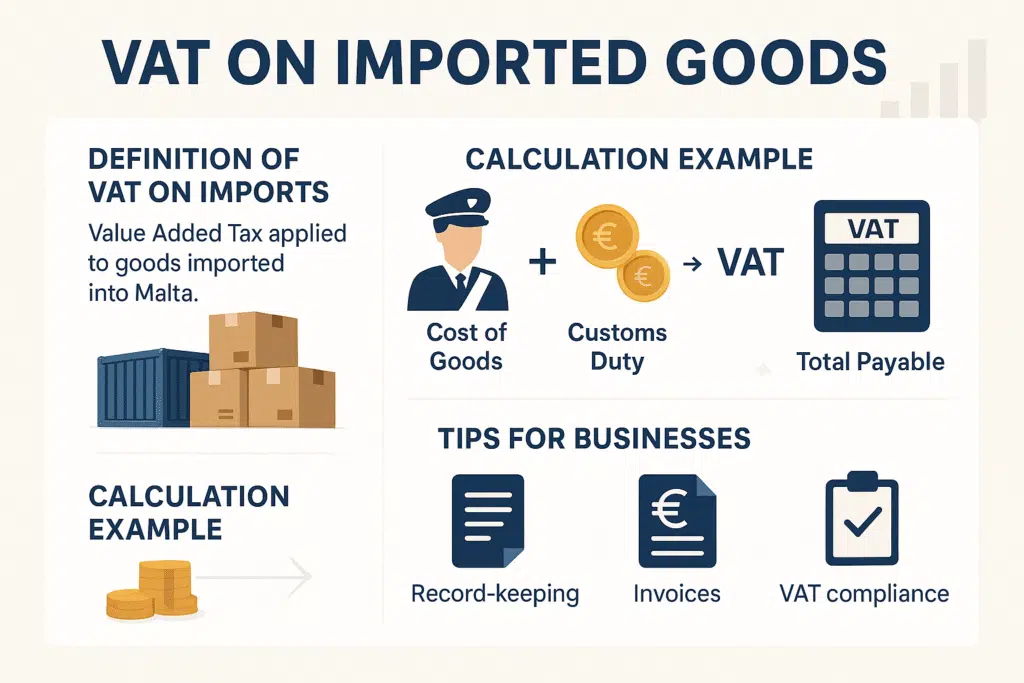

VAT on Imported Goods

If you import goods into Malta, VAT must be calculated on the cost of goods plus shipping, insurance, and any customs duties.

Example:

- Cost of imported goods: €200

- Shipping & insurance: €50

- Customs duty: €20

- Total taxable amount = €200 + €50 + €20 = €270

- VAT (18%) = 270 × 0.18 = €48.60

- Total amount payable = €270 + €48.60 = €318.60

This ensures that imports are taxed consistently with local goods.

VAT Accounting and Reporting

Businesses in Malta are required to file periodic VAT returns with the Commissioner for Revenue. Key points:

- VAT returns are usually submitted quarterly

- VAT collected from customers must be reported and paid

- VAT paid on business purchases can often be deducted (input VAT)

- Net VAT to be paid = Output VAT − Input VAT

Proper bookkeeping is essential to avoid errors and penalties.

Using Online Tools for VAT Calculation

To simplify VAT calculations, businesses can use online VAT calculators. These tools allow you to:

- Calculate VAT inclusive/exclusive amounts quickly

- Apply different rates automatically

- Keep accurate records for invoicing

You can find a reliable VAT calculator for Malta online and use it to save time.

Common Mistakes to Avoid

- Using the wrong VAT rate – Always verify which rate applies.

- Not including VAT in invoices correctly – Show net price, VAT, and total price separately.

- Mixing up net and gross amounts – Understand the difference between VAT-inclusive and VAT-exclusive prices.

- Failure to record VAT on imports – Include shipping, insurance, and customs duties in the taxable amount.

Example Summary Table

| Item | Net Price (€) | VAT Rate | VAT (€) | Total (€) |

|---|---|---|---|---|

| Laptop (standard rate) | 500 | 18% | 90 | 590 |

| Book (super reduced) | 50 | 5% | 2.50 | 52.50 |

| Hotel stay (reduced) | 200 | 7% | 14 | 214 |

This table makes it easier to visualize how VAT affects different products.

FAQs

How is VAT calculated in Malta?

In Malta, VAT is computed as a result of multiplying the net price of the goods or services by the VAT rate that is applicable (18, 7, or 5 percent).

How to calculate the VAT formula?

VAT Amount = Net Price × VAT Rate

Total Price = Net Price + VAT Amount

How do you calculate VAT?

Multiply the net price by the VAT rate. Example: €500 × 18% = €90 VAT. Total = €500 + €90 = €590.

How do you calculate 12% VAT?

VAT Amount = Net Price × 12%

Example: €200 × 0.12 = €24 VAT. Total = €200 + €24 = €224.

What is the VAT on 1200?

Assuming standard 18% VAT in Malta:

VAT = 1200 × 0.18 = €216

Total Price = 1200 + 216 = €1416

Read Also: How to Get a European Work Visa

final words

By understanding how VAT works and applying the correct formulas, you can calculate VAT accurately for any product or service in Malta. Whether it’s for standard rates, reduced rates, or special cases, following these steps ensures your pricing, invoicing, and tax reporting remain correct and hassle-free. Accurate VAT calculation not only keeps your business compliant but also helps you make smarter financial decisions.