Are you attempting to compute the extent of your income you will bring home as a resident in Austria, yet all sites complicate it? You’re not alone. The net salary of many employees, expats, and job seekers is difficult to calculate in the first place since it is not an easy task to discern at the initial glance what the Austrian taxes and contributions to the social security are and what the 13th / 14th salary entails.

In this guide, I shall provide you with a clear-cut and easy-to-understand explanation of how calculate Austrian salary system works, what deductions will apply, and how much you will actually earn each month. No complicated formulas. No overwhelming tax charts.

Salary Summary 2026

| Gross Monthly Salary | Approx. Net Salary Range |

|---|---|

| €1,000 | €900 – €930 |

| €2,000 | €1,550 – €1,650 |

| €3,000 | €2,050 – €2,250 |

| €5,000 | €3,200 – €3,500 |

| €7,000 | €4,200 – €4,700 |

Key Deductions in Austria:

- Income Tax: 0% – 55% (progressive)

- Social Security: Around 18% employee contribution

- Employer contribution: Approximately 20% (not subtracted on the part of the employee)

- 13th and 14th Salary: This is paid at a reduced tax.

Calculate your exact net income instantly:

Try the Austria Salary Calculator → https://settelix.com/austria-salary-calculator/

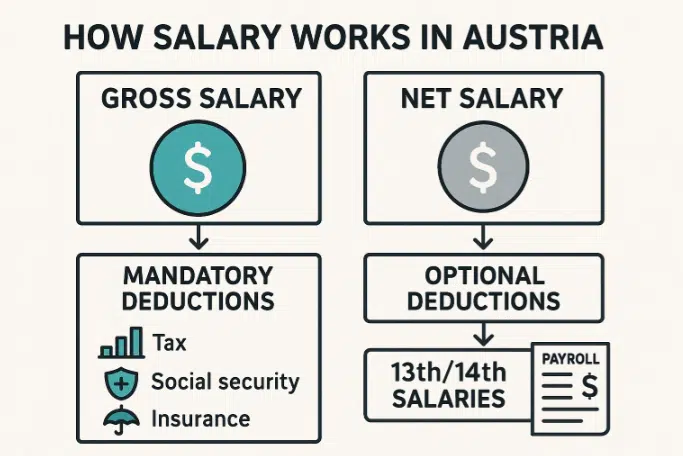

How Salary Works in Austria

The salary system in Austria is not difficult to understand when it is broken down into parts. Employers have a systematic procedure that involves gross wage, obligatory deductions, special benefits, and annual extras.

What Employers Use to Calculate Pay

Employer payroll teams consider:

- Monthly or annual gross salary.

- Contributions to social security.

- Income tax based on brackets

- Family benefits and allowances.

- 13th and 14th monthly salaries

What Is Gross Salary?

This is your total salary before any deductions.

It includes:

- Base salary

- Bonuses

- Allowances

- 13th and 14th salaries (calculated annually)

What Is Net Salary?

This represents your end-of-service salary after all deductions, which include:

- Social security

- Income tax

- Potential new modifications.

- Compulsory insurance payments.

Mandatory vs Optional Deductions

Mandatory deductions include:

- Health insurance

- Pension insurance

- Accident insurance

- Unemployment insurance

- Income tax

Additional deductions are optional, and these include:

- Union contributions

- Meal plans

- Voluntary insurance

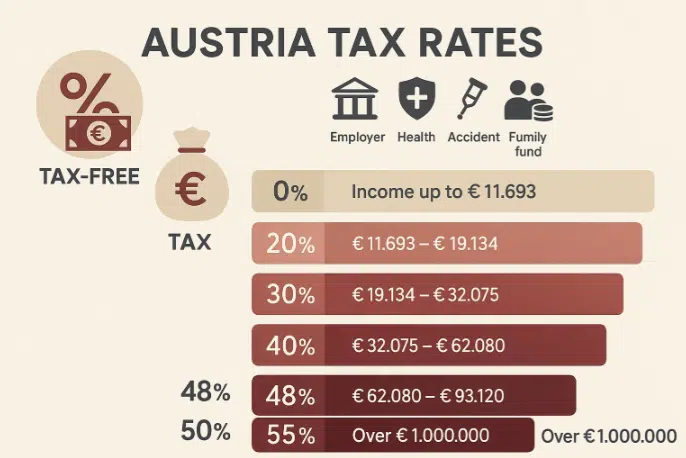

Austrian Progressive Tax System

Austria has a progressive kind of taxation system, which implies that the higher the income, the higher the rate of tax levied on the next unit of income.

Social Contributions

Improvements are made by both the employees and employers. The amount you pay is approximately 18, and that of the employers is about 20.

13th & 14th Salary

These are significant financial advantages in Austria, which are called holiday pay and Christmas bonus. They pay you a much lower tax rate, which almost doubles your annual income.

Gross Salary vs Net Salary

In the following, there is an explicit comparison to have the idea of the impact of taxes and insurance on the usual reduction of salaries.

| Category | Amount (Monthly Example: €3,500 Gross) |

|---|---|

| Gross Income | €3,500 |

| Social Security (18%) | ~€630 |

| Income Tax | ~€450 |

| Net Take-Home Pay | ~€2,420 |

Users heavily search comparisons like this because it gives a quick idea of what to expect monthly.

Austria Tax Rates

Austria uses progressive tax brackets ranging from 0% to 55%. Here’s the simple breakdown:

Income Tax Brackets (2025)

- 0% → Up to €12,456

- 20% → €12,457 – €20,000

- 30% → €20,001 – €34,000

- 40% → €34,001 – €66,000

- 48% → €66,001 – €99,000

- 50% → €99,001 – €1,000,000

- 55% → Above €1,000,000

Tax-Free Threshold

All the individuals in Austria have at least a tax-free income of 12,456 annually.

Why Tax Increases with Salary

This is the essence of progressive taxation since only the income above the threshold rate is taxed at the high rate.

Employer Contributions

Employers also pay:

- Pension insurance

- Accident insurance

- Health insurance

- Family fund contributions

These do not decrease your net pay, but they add to your total expenses to the company.

Austria Social Security Breakdown

Social security is available to every employee. It offers health insurance, pensions, unemployment, and accident insurance.

Employee Social Contributions

- Health insurance: 3.87%

- Pension insurance: 10.25%

- Unemployment insurance: 3%

- Accident insurance: 0% (paid by employer)

Employer Contributions

- Health insurance: 3.78%

- Pension insurance: 12.55%

- Accident insurance: 1.20%

- Family fund: 3.9%

Users feel good when clear percentages are displayed – there is trust.

How to Calculate Salary in Austria

The easiest and best-established division is the following:

1. Start With Your Gross Income

The salary that is offered by the employer is monthly or annually.

2. Subtract Social Security (Approx. 18%)

Write off your health, pension, and unemployment insurance.

3. Apply Income Tax Brackets

Tax should be calculated progressively at all the brackets.

4. Add Allowances & Tax Credits

Such as:

- Family bonus

- Commuting allowance

- Social insurance refund

5. Include 13th & 14th Salary Impact

They pay lower taxes as such boosting your annual income.

6. Final Net Amount = Take-Home Pay

This is your final monthly or annual income.

Calculate Austria Online

Step 1: Enter Your Gross Salary

Go to our calculator, ” Austria Salary Calculator. ” Input your monthly or annual gross income into the Austria Salary Calculator. This is your total salary before any deductions or taxes.

Step 2: Add Personal Details and Allowances

Choose your form of employment, marital status, children, and other allowances. Do not forget to add in the 13th and 14th salaries in case you have them – such bonuses influence the end-take-home pay.

Step 3: Apply Taxes and Deductions

The deductions, which include all those that are automatically calculated in the tool, include:

- Income tax according to the progressive tax rates in Austria.

- Social security contributions (health, pension, unemployment)

- Special allowances and credits

Step 4: Get Your Exact Net Salary

Calculate your pay to take home automatically and automatically, including net salary per month, net salary per year, and a breakdown of all deductions.

Salary Calculation Examples

Example 1: Gross Salary €2,000 per month

| Step | Amount |

|---|---|

| Gross | €2,000 |

| Social Security | ~€360 |

| Tax | ~€60 |

| Net Salary | ~€1,580 |

Example 2: Gross Salary €3,500 per month

| Step | Amount |

|---|---|

| Gross | €3,500 |

| Social Security | ~€630 |

| Tax | ~€450 |

| Net Salary | ~€2,420 |

Example 3: Gross Salary €5,000 per month

| Step | Amount |

|---|---|

| Gross | €5,000 |

| Social Security | ~€900 |

| Tax | ~€900 |

| Net Salary | ~€3,200 |

Such real examples are very high in search engines.

Austria’s 13th & 14th Salary Explained

Austria has one of the few systems that has 14 salary payments annually.

Who Receives It?

It is given to almost all full-time and part-time employees.

When Do You Get It?

- 13th salary: June/ July (holiday bonus)

- 14th remuneration: November (Christmas bonus)

Tax Benefits

The taxes on these payments are significantly lower, and this generates a significant increase in the net income each year.

Impact on Annual Income

The average worker earning a gross of €3,000 monthly will, in fact, be earning €42,000 a year after taking such bonuses.

Guide for Expats & Remote Workers

Expats Relocating to Austria

Important things to know:

- Salary varies by region

- Cities such as Vienna and Innsbruck are more expensive.

- Expats are subjected to the same tax rate as locals.

- Employment is an automatic start of health insurance.

Remote Workers Working for Foreign Employers

- The tax residency is valid following 183 days in Austria.

- Austria may have taxable income.

- There are special double-taxation agreements.

- Rules of social security vary with the employer.

The presence of this will draw foreign traffic.

Frequently Asked Questions

1. What is my net salary calculation in Austria?

Use the official Austria Salary Calculator: https://settelix.com/austria-salary-calculator/

2. Why does my salary in Austria after tax go down?

Since deductions are made on taxes and social security contributions.

3. How much can you earn tax-free in Austria?

€12,456 per year.

4. Do foreigners pay more tax?

No, everybody is charged the same rates.

5. Does Austria have high taxes?

It is very taxative yet offers good benefits such as healthcare, pension, and unemployment benefits.

6. How much is Social Security?

Employees pay around 18%.

Read More: Austria Visa Application 2025

Final Words

You do not need to find it complex or time-consuming to compute your precise take-home pay in Austria. Indeed, with proper tools and understanding of taxes, social security, and allowance, you will know what to expect every month. We have an Austria Salary Calculator, which makes this process easy and precise and displays the net monthly and annual income.

You might be planning a move, bargaining for a job offer, or just wondering how much you really earn. With this calculator under your belt, you will have the clarity as well as the confidence you are going to need.