Are you planning to travel with Health Insurance for Schengen? Then, you are in the right place. One of the biggest requirements associated with traveling to Europe, particularly the Schengen Area, is travel health insurance. You cannot afford to go without the right Schengen visa insurance, whether your destination is Schengen countries as a tourist, a business person, a student or visiting parents. In its absence, your visa can be denied.

In this detailed guide, you’ll discover exactly how to get Schengen travel insurance, which providers are trusted by embassies, what the coverage requirements are, how much it costs, and step-by-step instructions to secure it online.

What Is Travel Health Insurance for a Schengen Visa?

Medical insurance Schengen is a unique type of medical cover plan that covers medical charges during your stay in the 26 Schengen regions in Europe.

- It is a requirement in getting a Schengen visa.

- It also covers the case of hospitalization, accident, and emergency evacuation.

Which Countries Require Schengen Travel Insurance?

This is the list of Schengen countries where travel insurance is mandatory for visa applicants:

Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland.

Schengen Visa Insurance Requirements

An insurance plan must meet the following requirements before being selected:

Minimum Requirements:

| Requirement | Description |

|---|---|

| Minimum coverage | €30,000 or more |

| Coverage area | Must be valid in all Schengen states |

| Coverage type | Emergency medical, hospitalization, repatriation (including death) |

| Duration | Must cover the entire stay in the Schengen zone |

| Insurance provider | Must be recognized by Schengen embassies/consulates |

Method 1: Buy from an Authorized Travel Insurance Company

You can get health insurance from an Authorized Travel Insurance Company. All the steps to get it are given below:

Step-by-Step Process

1. Find Embassy-Approved Insurers

It must always refer to reliable companies and those that the Schengen embassies trust. They are the following, most popular of them:

- AXA Assistance

- Allianz Travel

- Europ Assistance

- HanseMerkur

- MondialCare

- ICICI Lombard

- EFU or Adamjee Insurance

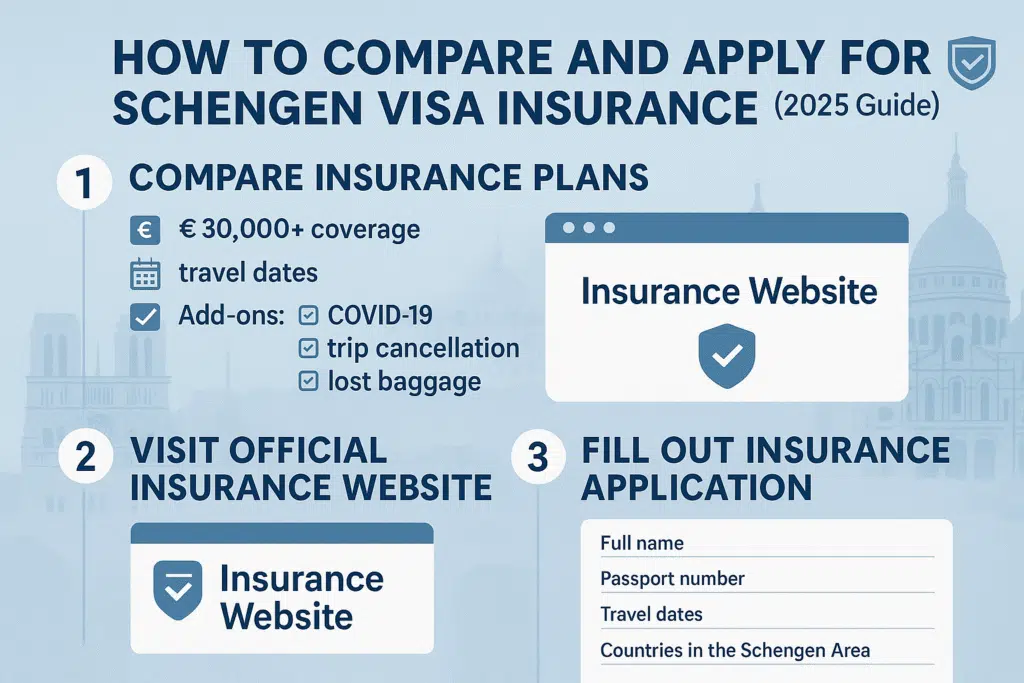

2. Compare Insurance Plans

In the process of a comparison, it is important to notice:

- Coverage (At least 30,000 Euros and more, where possible)

- Travel Dates (Insurance should be congruent to your entry and exit dates)

- Add-ons (COVID-19, trip cancellation, lost baggage, etc.)

3. Visit the Company’s Official Website

Even when you find sellers, you cannot trust them either. Do not forget to bother to approach the official web page of the insurer and apply there.

4. Fill Out the Application

The bulk of the companies embrace:

- Full Name

- Passport Number

- Travel Dates

- Countries in the Schengen area

5. Make Payment Securely

Most companies are okay with:

- Credit/Debit Card

- Bank Transfer

- Mobile wallets (for local companies)

6. Get Your Insurance Certificate by Email

It takes some two minutes or a few hours, and you will be provided with the PDF policy. Check for:

- Passport number and first name

- Coverage information

- contact information on emergencies

- Name, the logo of the organization, and the number of certificates of the insurers

Method 2: Book via Trusted Travel Agents or Visa Consultants

In the case of using a visa consultancy firm and travel organization, probability is probable that they would organize the Schengen insurance; even better, they will help you save hours and indecision.

Step-by-Step Process

1. Choose a Reputable Travel Agent

Only the licensed services should be used to travel in: Services that the embassies feel comfortable with:

- VFS Global

- Gerry’s Visa

- BLS International

- Agents having experience with Schengen visas at the local level

2. Share Your Travel Details

Before you pay, ask yourself:

- Passport

- Dates of travel

- Destination countries

3. Review the Insurance Package They Offer

Before you pay, Instantan by event:

- Is the embassy accepting this insurance?

- What happens if I am denied a visa?

- Does it extend beyond € 30,000 and all Schengen countries?

4. Pay Through the Agent

They may ask for:

- Cash

- Bank Transfer

- Online Payment Link

5. Collect and Verify the Insurance Certificate

Once they have sent your policy via email or printed it out, then you had better:

- Your full name and last name in your passport and your first name

- The length and number of selectors at hand

- Embassy compliance

Read Also: How to Get Malta Citizenship in 2026: All 3 Legal Routes

Method 3: Use Visa Appointment Portals (VFS, BLS, TLS)

1. Go to Your Country’s Official Visa Portal

Examples:

- VFSGlobal.com

- TLSContact.com

- Gerry’s Visa Services

- BLS International

2. Choose Your Destination Country

Visit the webpage that contains the information on visas to the country you are going to visit.

3. Pay Online and Download Instantly

The insurance certificate will be immediately sent to your email address.

Method 4: Buy Online via Insurance Aggregators (Fast & Easy)

They provide you with the possibilities of comparing various insurance companies to each other and by a provider who is accepted by the embassies and purchase it online after several minutes.

Recommended Aggregator Websites

Step-by-Step Process

1. Visit a Trusted Aggregator Website

You can pick any of the above based on your choice and the country you choose.

2. Enter Travel Information

By way of filling in, you will be asked to fill in:

- Travel Dates

- Destination (Schengen area)

- Age & Nationality

- Add-ons (optional): COVID cover, trip delay, etc.

3. Compare Available Policies

Focus on:

- The embassy accepts stamps or logos

- Clear refund policy (in case of visa rejection)

- Coverage breakdown

- User reviews and ratings

4. Pay Online & Download Certificate

Once payment is made, it takes a matter of a few minutes before the certificate is availed in the email inbox.

FAQs

1: Which is the most suitable travel insurance for a Schengen visa in 2026?

Emergency treatment and repatriation are costing more than 30,000 euros, and the minimum possible costs of the most reasonable travel insurance is over 30,000 euros.

2. Is there a need to be insured when applying for a Schengen visa?

Yes, it’s mandatory. Your medical cover should be at least 30000 euros worth of spending on health, and accepted by all the Schengen countries, and it must have a repatriation cover.

3: Can I buy Schengen travel insurance after applying for the visa?

No. You have to have a valid insurance cover in terms of travel in order to apply. Without the same, the submission may be rejected.

4: How many days of insurance do I need for a Schengen visa?

You should have insurance coverage throughout your stay. It will require an additional 1-2 days, according to precaution.

Read Also: How to Get Spanish Citizenship in 2026 (All Legal Paths)

Final Thought

The fact that you took travel health insurance is not a formality when you are applying for your Schengen visa. Otherwise, you may not stand a chance of being granted the visa.

- Cover medical expenses at least 30,000 euros

- It is acceptable in all the Schengen countries

- There was coverage on emergency and repatriation.

Submit the applications early enough, update the information and ensure you do your purchase at the original stores. But with proper insurance, there is only one step that you have to take prior to traveling across your European experience.