Would you like to know how much you are going to bring home in Cyprus every month? It is easy to get lost in deciding how to calculate your salary, taking into account income taxes, payment of social security, and allowances. Be it an expat who has to budget or a local worker who has to work out his/her finances, it is vital to know what your net salary is.

We are also going to step-by-step demonstrate how to calculate the salary in Cyprus, we will explain the difference between gross pay and net pay, and we will demonstrate how taxes and contributions actually affect the take-home pay.

Salary in Cyprus

It is preferable to know what your salary is comprised of and then balance the calculations.

Gross Salary vs Net Salary

- Gross Salary: it is the amount of money that you have signed in your employment contract and pre deductions.

- Net Salary: The amount you actually receive after taxes, social security contributions, and other deductions.

Example: By supposing that you have a gross salary of 3000, the deductions of 600 per month, you will have a net salary of 2400.

Components of Salary

- Basic Salary: It is the minimum rate of pay that you get.

- Allowances: This is an extra pay, such as accommodation, transportation, or performance bonuses.

- Deductions: This refers to income tax, social insurance, and other statutory contributions.

These are the first parts you need to know in order to calculate your exact take-home salary in Cyprus.

Taxes and Contributions in Cyprus

There is an organized income tax and social security contribution system in Cyprus. These rates are necessary to calculate salaries.

Income Tax Rates in Cyprus

Cyprus uses a progressive income tax system. The rates for individuals in 2025 are:

| Taxable Income (EUR) | Tax Rate |

|---|---|

| 0 – 19,500 | 0% |

| 19,501 – 28,000 | 20% |

| 28,001 – 36,300 | 25% |

| 36,301 – 60,000 | 30% |

| Over 60,000 | 35% |

Social Security Contributions

Social insurance is provided by both employees and employers. For employees:

- Employee contribution: 8.3 percent of gross salary.

- Employer contribution: 8.3% of gross salary

Pensions, healthcare, and other benefits are covered in Social Security. These are compulsory contributions, which are automatically deducted from your pay.

Read Also: Insider Malta Visa Guide

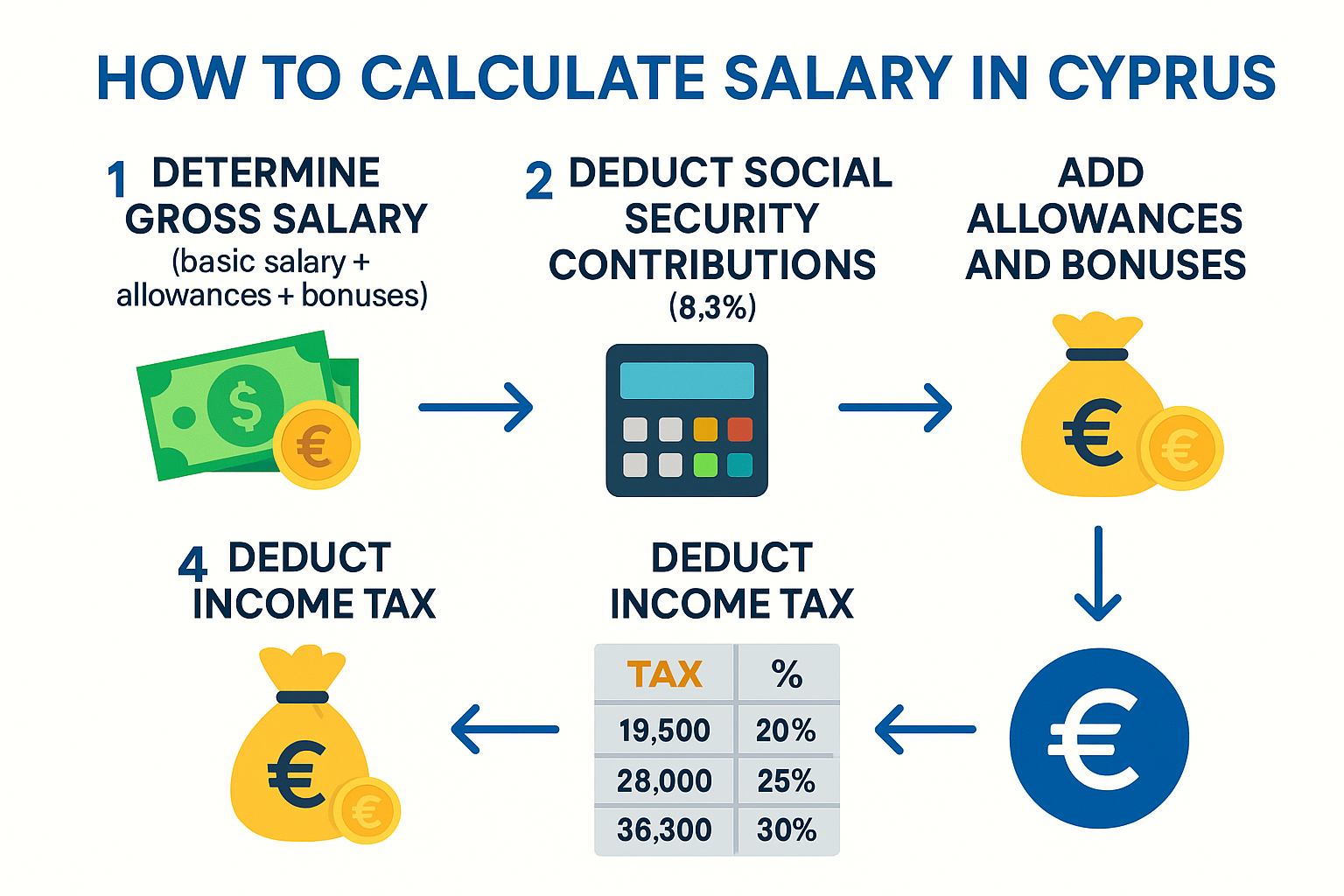

Step-by-Step Guide to Calculate Your Salary in Cyprus

These are the steps to take when calculating your net salary as an expat.

Step 1: Determine Your Gross Salary

Your gross salary will consist of your basic salary + allowances + bonuses. For example:

- Basic salary: €2,500

- Housing allowance: €300

- Bonus: €200

Gross Salary: €3,000

Step 2: Deduct Social Security Contributions

Your gross salary is computed at 8.3 percent to come up with social insurance:

Gross Salary × 8.3% = Social Security Contribution

€3,000 × 0.083 = €249

Step 3: Deduct Income Tax

After social security, calculate your taxable income. Subtract the personal allowance (first €19,500 is tax-free) and apply the relevant tax rate:

- Taxable income = €3,000 × 12 months = €36,000 annual

- Tax calculation:

- 0 – 19,500 → 0% = €0

- 19,501 – 28,000 → 20% of €8,500 = €1,700

- 28,001 – 36,000 → 25% of €8,000 = €2,000

Total Annual Tax: €3,700 → Monthly Tax ≈ €308

Step 4: Add Allowances and Bonuses

Certain housing or meal allowances are tax-free some allowances. Add the following deductions where necessary.

Step 5: Calculate Net Salary

Finally, subtract deductions from gross salary:

Gross Salary: €3,000

- Social Security: €249

- Income Tax: €308

Net Salary ≈ €2,443

Example Salary Calculation in Cyprus

An example of a net monthly income of 4,000 euros is shown below:

| Component | Amount (€) |

|---|---|

| Gross Salary | 4,000 |

| Social Security (8.3%) | 332 |

| Income Tax | 508 |

| Net Salary | 3,160 |

For a fast and accurate calculation, you can use the Cyprus Tax Calculator to see your real net salary instantly.

Tips to Maximize Your Take-Home Salary

- Receive tax-free allowances: Some allowances are not taxed, making your net salary go up.

- Plan bonuses in a strategic manner: There can be different taxation of certain bonuses.

- Take into account part-time or freelance deductions: In case they are qualified, certain deductions may help to minimize the taxable income.

- Annual review: It is possible to review tax rates and percentages of social security annually.

Frequently Asked Questions (FAQs)

Computation of the income tax in Cyprus?

Income tax is progressive. The initial 19500 of your income is tax-free, and the rest is taxed at pre-determined rates.

How much does one contribute to Social Security?

Employees contribute 8.3 per cent gross salary, and so does the employer.

Are expats entitled to tax deductions?

Yes, the expatriates can be entitled to allowances and deductions based on their residence and type of income.

How can I increase my net salary?

Take tax-free allowances, negotiate allowances in your contract, and think about bonuses.

Read More: Italy Visa Application Tracking: 4 Easy Online Methods

Final Words

To compute your salary in Cyprus is not a difficult task, as long as you follow all the above steps. Take your gross salary, subtract social security amounts, add interest in income tax, and add any allowance or bonuses to determine your net take-home pay.

To get a quick and correct calculation, the Cyprus Tax Calculator should not be neglected as it is easy to use, quick, and accurate.